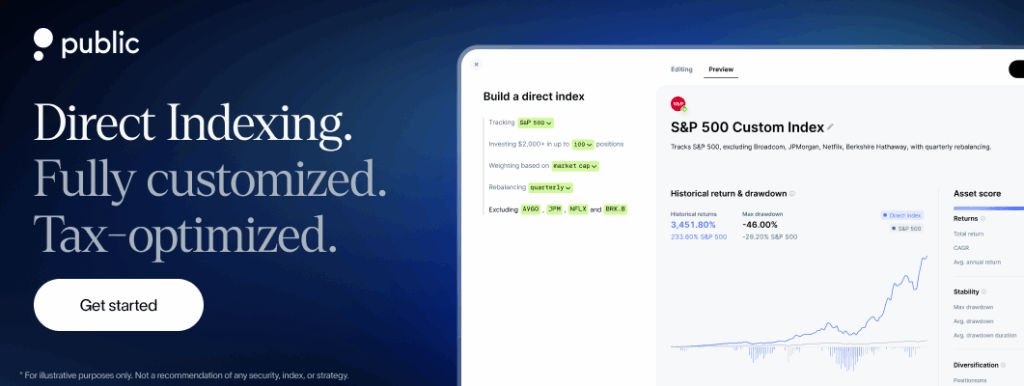

What if you could invest in the S&P 500 and save thousands in taxes at the same time?

That’s the power of direct indexing. This investment strategy aims to deliver better after-tax returns annually compared to traditional index funds and it’s no longer just for the ultra-wealthy. What once required $250,000 and a team of advisors now starts at just $1,000 on Public.

Direct indexing combines the simplicity of index investing with powerful tax optimization and complete portfolio customization. Whether you’re a high earner looking to offset capital gains, an executive with concentrated stock positions, or a values-driven investor wanting control over your holdings, direct indexing offers a smarter way to build wealth.

What is Direct Indexing? How it works

Direct Indexing is a portfolio that holds individual stocks designed to track a chosen market index. You can customize holdings, set a rebalancing schedule, and apply tax-loss harvesting. This approach can provide more control than an ETF, since you directly own each security.

Simple flow

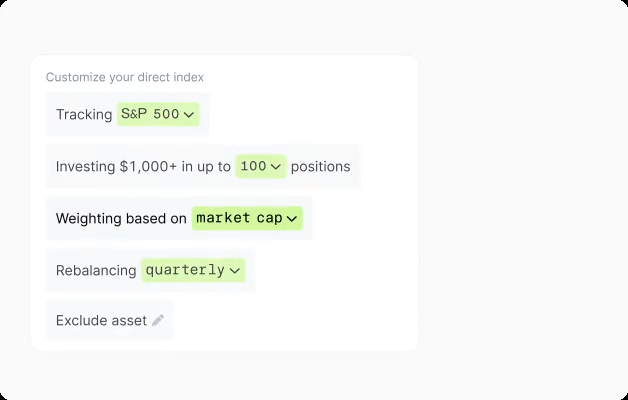

- Choose an index to track.

- Decide how to weight positions, for example market-cap or equal weight.

- Pick a rebalancing cadence.

- Personalize by excluding any stocks you prefer not to hold.

Direct Indexing now on Public

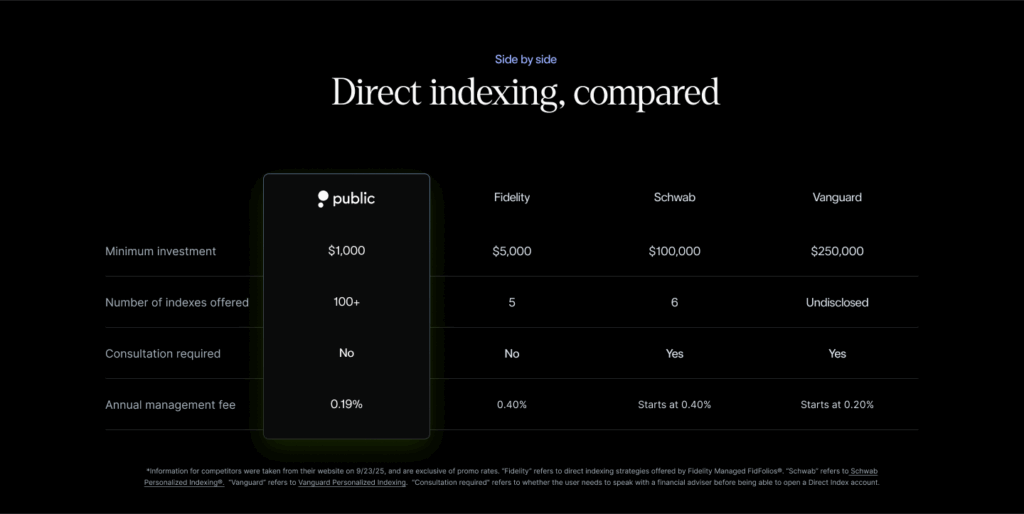

Public offers Direct Indexing with several features that are usually reserved for higher minimums on other platforms.

- Low minimum: start with $1,000. Public notes that smaller starting balances may only track a subset of an index’s full holdings.

- 100+ indices to choose from, including broad benchmarks like the S&P 500 and themed indices such as AI semiconductor makers or dividend strategies.

- Ownership and control: directly own each component security and exclude individual stocks that do not fit your preferences.

- Weighting options: match index weights by market cap or choose equal weight.

- Rebalancing and tax-loss harvesting: technology monitors for opportunities when your portfolio rebalances or when cash moves in or out. Public states that tax-loss harvesting starts 14 days after account opening.

- Transparent advisory fee: 0.19% annual management fee for Direct Indexing accounts.

Why this matters

Public’s $1,000 entry point and 0.19% advisory fee position it as one of the most accessible direct indexing options for retail investors while still offering broad index selection and automation.

Benefits of Direct Indexing

- Tax efficiency: Potential for improved after-tax returns through systematic tax-loss harvesting, which can capture losses throughout the year instead of only at year-end.

- Customization: Flexibility to exclude or include specific companies or industries that do not align with your goals or values.

- Direct ownership: Investors hold the individual securities, which allows for charitable giving of appreciated shares and estate planning strategies.

- Flexible tax treatment: Realized losses can be used to offset gains or carried forward for future use, depending on tax rules.

- Transparency: Full visibility into each security you own, unlike pooled structures such as ETFs or mutual funds.

Limitations of Direct Indexing

- Higher costs: Advisory or management fees for Direct Indexing are generally higher than the expense ratios of index ETFs or mutual funds.

- More complex reporting: Managing many individual securities can increase reporting requirements compared with a single pooled vehicle.

- Minimum investment requirements: Many Direct Indexing programs require a minimum balance, which can vary widely by provider.

- Best suited for taxable accounts: The main tax benefits do not apply in retirement accounts like IRAs or 401(k)s.

- Tracking error: Heavy customization or smaller account sizes can lead to returns that deviate from the benchmark index.

Who should consider Direct Indexing

Direct Indexing may be suitable for investors who want index exposure with greater flexibility, the ability to exclude specific securities, and automated tax-loss harvesting. It can be particularly useful for:

- High-income earners in the 24%+ federal tax bracket.

- Investors with capital gains from stocks, real estate, or business sales.

- Residents of high-tax states such as California, New York, or New Jersey.

- Concentrated stock holders, including executives with RSUs or large company stock positions.

- Values-based investors seeking to exclude certain companies or industries.

- Philanthropic givers who donate appreciated securities.

- Long-term investors holding assets in taxable brokerage accounts.

Conclusion

Direct indexing aims to deliver better after-tax returns annually through systematic tax-loss harvesting. Over a long investment horizon, that may compound to thousands of dollars in additional wealth.

Public has democratized this strategy. With a $1,000 minimum (much lower than competitors), 0.19% fee (one of the lowest in the industry), and 100+ indexes (20x more options than competitors), Public removes barriers that made direct indexing exclusive and expensive

Whether you’re a tech executive with RSUs, a real estate investor with gains to offset, or a high earner wanting to keep more of what you make, direct indexing on Public offers a smarter way to build wealth. The platform is fully automated, requires no advisor consultations, and puts institutional-grade tax optimization at your fingertips in minutes.

Frequently Asked Questions

Which platforms offer Direct Indexing?

Public offers Direct Indexing with a $1,000 minimum and a 0.19% annual advisory fee, making it accessible to more retail investors. Other platforms such as Schwab, Fidelity, and Vanguard also provide direct indexing, but their minimums are typically much higher

How can I get started with Direct Indexing?

You can open a Direct Indexing account directly on Public.com with a $1,000 minimum. Select from over 100 indices, choose your weighting and rebalancing schedule, exclude specific stocks, and benefit from tax-loss harvesting.

What are the fees and minimums for Direct Indexing?

Direct Indexing on Public requires a $1,000 minimum, making it more accessible to retail investors, and charges a 0.19% annual advisory fee.

Can I exclude stocks when using Direct Indexing?

Yes. Public.com lets you exclude individual companies that do not align with your values or strategy, while still maintaining diversified exposure to the rest of the index.

Does Direct Indexing include tax-loss harvesting?

Yes. Public.com’s Direct Indexing includes tax-loss harvesting. After a 14-day initial period, the system checks for opportunities during each rebalance and whenever deposits or withdrawals are made.

Who offers the lowest fees for Direct Indexing?

Public.com charges a 0.19% annual advisory fee for Direct Indexing, which is among one of the lowest published fees in the industry for Direct Indexing strategy.