Treasury Account

Treasury ladders.

Simplified.

It’s never been easier to earn passive income with a customizable ladder of US Treasuries. Plus, your earnings are exempt from state and local taxes.*

Lock in a government-backed yield.

A Treasury Account lets you invest in a ladder of US Treasuries with maturities from 3 months to 30 years. Choose a pre-built ladder to match your timeline, or build your own. Then, enjoy steady income from what is widely considered one of the safest investments for your portfolio.

Pick or build your ladder

We've tailored our ladder options to fit various time horizons, or you can create your own.

Invest your cash

You can get started with as little as $1,000. Future deposits have no minimum requirements.

Reinvest or cash out

When your Treasuries reach maturity, you have the flexibility to reinvest or cash out.

*The average yield displayed for the ladder at the time of your investment is estimated and assumes that: (1) all Treasuries in the ladder are held until maturity; (2) all interest and maturity payments are reinvested into the longest duration Treasury in your ladder; and (3) any reinvestment will be at the same rate as today’s yields. Your actual yield may vary from this estimate due to factors such as reinvestment rates and sales prior to maturity. Interest earned from Treasuries is generally exempt from state and local taxes, but any capital gains from sale of Treasuries prior to maturity is not exempt.

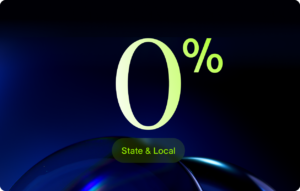

Pay zero state and local taxes

Interest from US Treasuries is exempt from state and local income taxes*—letting you keep more of your earnings, especially if you live in a high-tax area.

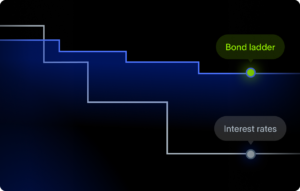

Rates may fall.

Your yield won’t.

A Treasury Account on Public allows you to lock in your yield at purchase*, so you know exactly what you'll earn—even if the Fed cuts interest rates.

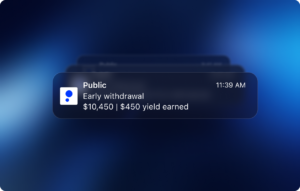

Access your cash.

Anytime.

US Treasuries are highly liquid, so you can sell early if needed. However, keep in mind that sales prior to maturity may incur costs and affect your realized yield.

Safe returns.

Backed by the US government.

US Treasuries are backed by the full faith and credit of the US government and are considered one of the safest investments for your portfolio.

Have questions? Find answers.

What are Treasuries?

US Treasuries are debt securities issued by the federal government. When you purchase one, you’re lending money to the government in exchange for either periodic interest payments or a guaranteed return at maturity. There are three main types: Treasury bills (T-bills), which mature in one year or less; Treasury notes (T-notes), with maturities between two and ten years; and Treasury bonds (T-bonds), which mature in 20 or 30 years.

What is a Treasury Account?

A Treasury Account lets you invest in a ladder of US Treasuries with staggered maturities. Think of it like spacing out your investments—when one Treasury matures, you can either reinvest the money or use it if you need it. This approach helps balance flexibility and long-term growth, giving you access to cash at regular intervals while still benefiting from the potential returns of longer-term Treasuries.

How does a Treasury Account work?

It only takes a few minutes to get started with a Treasury Account on Public. You can choose from pre-built Treasury ladders designed for different time horizons or build your own from scratch. Then, with a minimum deposit of $1,000, you’ll start earning a government-backed yield. You also have the flexibility to cash out your investments early if you need to.

Is earned interest from the Treasury Account taxable?

The interest you earn from a Treasury Account is taxable, but with a key advantage: it is exempt from state and local taxes. This means you get to keep more of your earnings, especially if you live in a high-tax area.

What happens when my Treasuries mature?

When your Treasuries mature, you have two options: you can automatically reinvest the proceeds into a new Treasury with a maturity matching the longest term in your ladder, or you can withdraw the cash. The choice is yours.

Why should I consider Treasuries for my portfolio?

US Treasuries are backed by the full faith and credit of the US government and are considered one of the safest investments for your portfolio. That’s why many investors turn to them as a reliable way to generate yield. Treasuries also tend to offer higher returns than traditional savings accounts, providing an easy way to put your cash to work while maintaining stability in your portfolio.

Are there fees associated with the Treasury Account?

Yes, there are management fees associated with managing your Treasury Account and transaction fees associated with every trade. Management fees are tiered, starting at 0.29% and decreasing to 0.09% based on account size. Transaction markups are 0.10%-0.25% of par value, depending on duration. For more details, see Public Advisors’ Fee Schedule

Ready to build your custom ladder of US Treasuries?