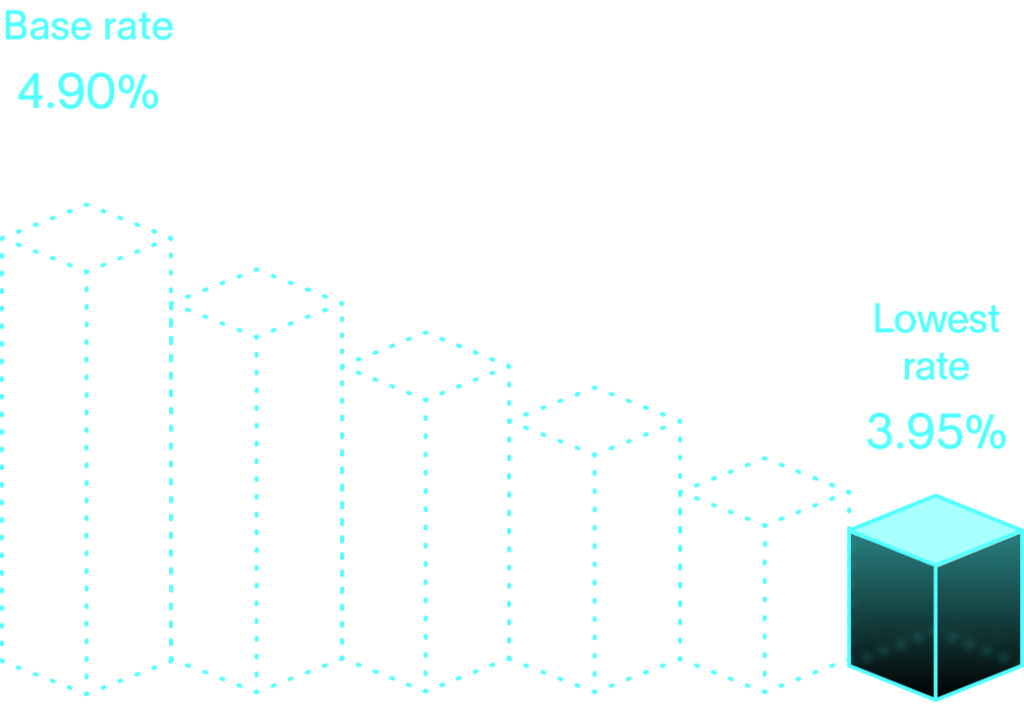

Access the lowest margin rates among leading brokerages

Increase your buying power with the lowest range of margin rates among leading US brokerages.*

| Compare the introductory margin rates from leading US brokerages Compare the introductory margin rates from leading US brokerages | |

|---|---|

|

Public | 4.90% 4.90% |

| Robinhood Robinhood | 5.00% 5.00% |

| Interactive Brokers lite Interactive Brokers lite | 6.14% 6.14% |

| Fidelity Fidelity | 11.83% 11.83% |

| Charles Schwab Charles Schwab | 11.83% 11.83% |

| Vanguard Vanguard | 12.00% 12.00% |

| E*TRADE E*TRADE | 12.25% 12.25% |

Rates of other brokerages are based on information published on their website as of 12/12/25, are exclusive of promotional offers, and are subject to change. “Introductory rate” refers to the margin rate for the minimum margin balance tier offered by Public or each competitor. “Leading US brokerages” refers to brokerages that are publicly-traded or have significant brand recognition and market share.

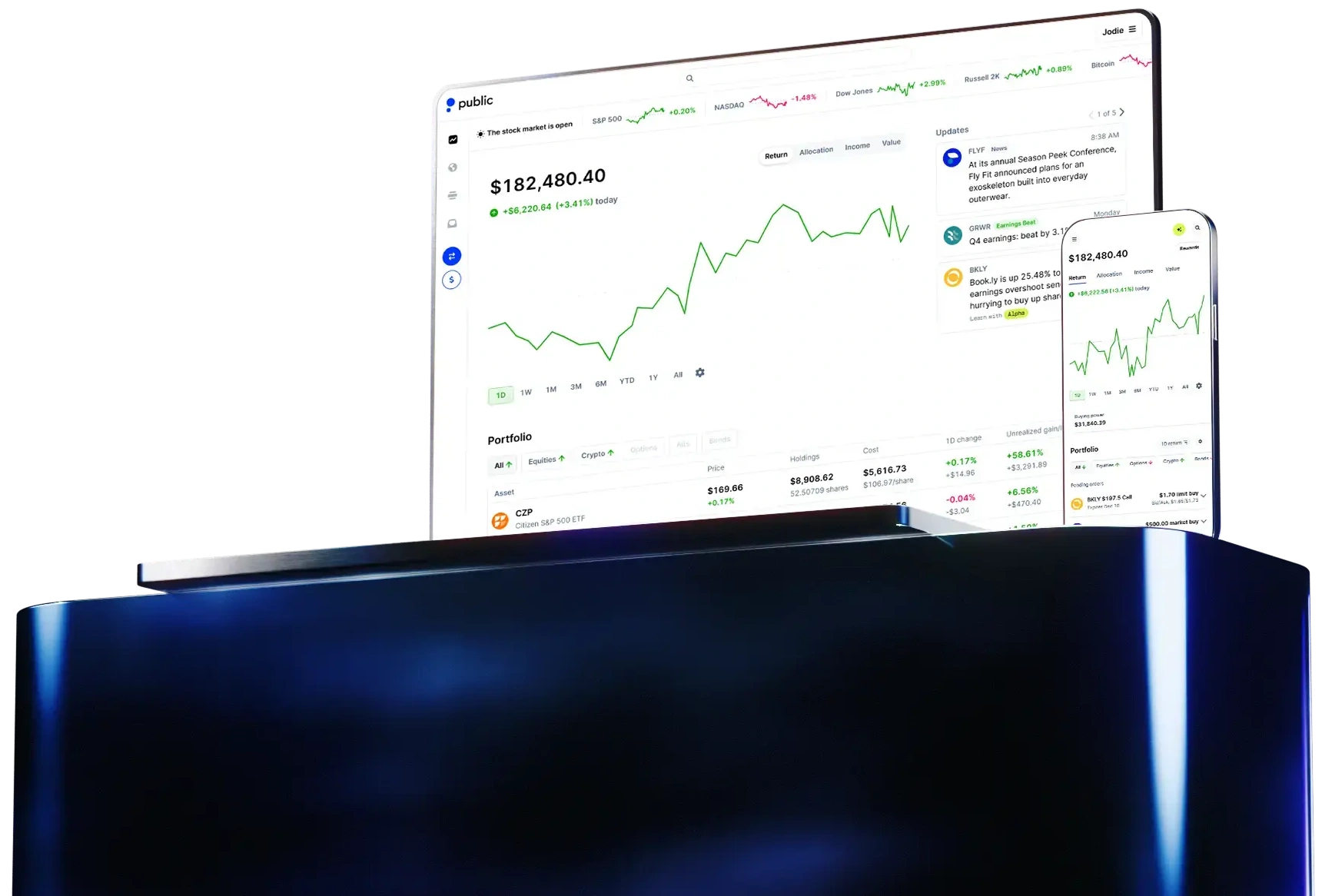

Amplify your investment potential

When you enable margin on Public, you can borrow against your existing holdings to increase your buying power and amplify your potential returns.

Borrow at some of the industry’s lowest rates.

Access more capital without selling assets.

Monitor your margin risk factors in real time.

Borrow for less.

Across the board.

| Margin Balance Margin Balance | Interest Rate Interest Rate |

|---|---|

| Up to $50,000 Up to $50,000 | 4.90% 4.90% |

| $50,001 - $100,000 $50,001 - $100,000 | 4.75% 4.75% |

| $100,001 - $1M $100,001 - $1M | 4.50% 4.50% |

| $1M - $10M $1M - $10M | 4.25% 4.25% |

| $10M - $50M $10M - $50M | 4.20% 4.20% |

| $50M+ $50M+ | 3.95% 3.95% |

*See Fee Schedule and margin risk disclosure for additional details.

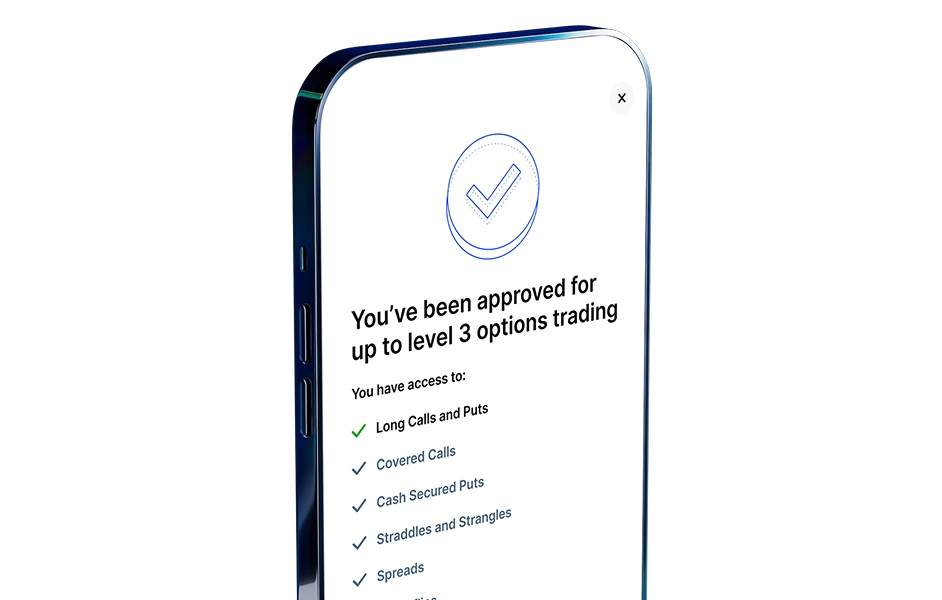

Expand your options trading playbook

Level 3+ options traders with margin investing enabled can access advanced strategies, including credit spreads, butterfly spreads, and iron condors.

Access our API for

programmatic trading

With the Public API, you can tap into real-time market data and automate your trading—all while earning rebates on your stock and ETF contracts.

Learn moreHave questions? Find answers.

What is margin investing?

Margin investing on Public enables you to increase your buying power by leveraging the stocks and bonds in your portfolio as collateral for a loan. When you invest on margin, you can capitalize on market opportunities and acquire more assets than with cash alone, potentially amplifying your gains.

How do margin interest rates work on Public?

When you enable margin investing on Public, we charge an interest rate that varies depending on your margin/debit balance and the upper limit of the Federal Funds Target Range. Rates are calculated using a set formula, which may change over time to reflect market conditions and regulatory updates.

What are the requirements to qualify for margin investing?

To qualify for margin investing on Public, we consider several factors, including your trade history and brokerage account balance. It only takes a few minutes to apply.

How do I get started with margin investing on Public?

If you’re already a Public member, you can apply to start margin investing by navigating to your Settings and Privacy and selecting Margin Account. If you’re new to Public, it only takes a few minutes to begin your account application. You can apply for margin investing once your account is active.

Have additional questions about Stocks on Public?

Our US-based customer experience team has FINRA-licensed specialists standing by to help.

Enable margin on Public