Trade Bitcoin ETP Options on Public

Options on Bitcoin exchange-traded products (ETPs) made their debut on Nov. 19, 2024 offering a new way to invest in crypto.

What are Bitcoin ETP options?

Bitcoin ETP options are financial derivatives tied to Bitcoin Exchange-Traded Products (ETPs). These options let traders buy or sell a Bitcoin ETP at a predetermined price before a specific expiration date. There are two main types:

- Call options give the option owner the right, but not the obligation, to purchase the Bitcoin ETP at a specific price until the option expires.

- Put options give the option owner the right, but not the obligation, to sell the Bitcoin ETP at a specific price until the option expires.

Bitcoin exchange-traded products (ETPs) listed on U.S. exchanges and is not a direct investment in Bitcoin. Bitcoin ETPs are highly speculative and are subject to increased volatility.

Past performance is no guarantee of future results. Investing involves risk, including risk of loss of principal. Investors should consider the fund’s investment objectives, risks, charges, and expenses and unique risk profile. Please read the prospectus carefully before investing. See here for the IBIT prospectus, FBTC prospectus, ARKB prospectus, BITB prospectus, BTC prospectus, and GBTC prospectus.

This spot bitcoin exchange-traded product (“ETP”) is not an investment company registered under the Investment Company Act of 1940 (the “1940 Act”) and is not subject to regulation under the Commodity Exchange Act of 1936 (the “CEA”). As a result, shareholders do not have the protections associated with ownership of shares in an investment company registered under the 1940 Act or the protections afforded by the CEA.

How to trade Bitcoin ETP Options on Public

1. Sign up and fund your account

Getting started with Public is easy. Sign up on our website or download the Public app, then securely link your bank account to deposit funds.

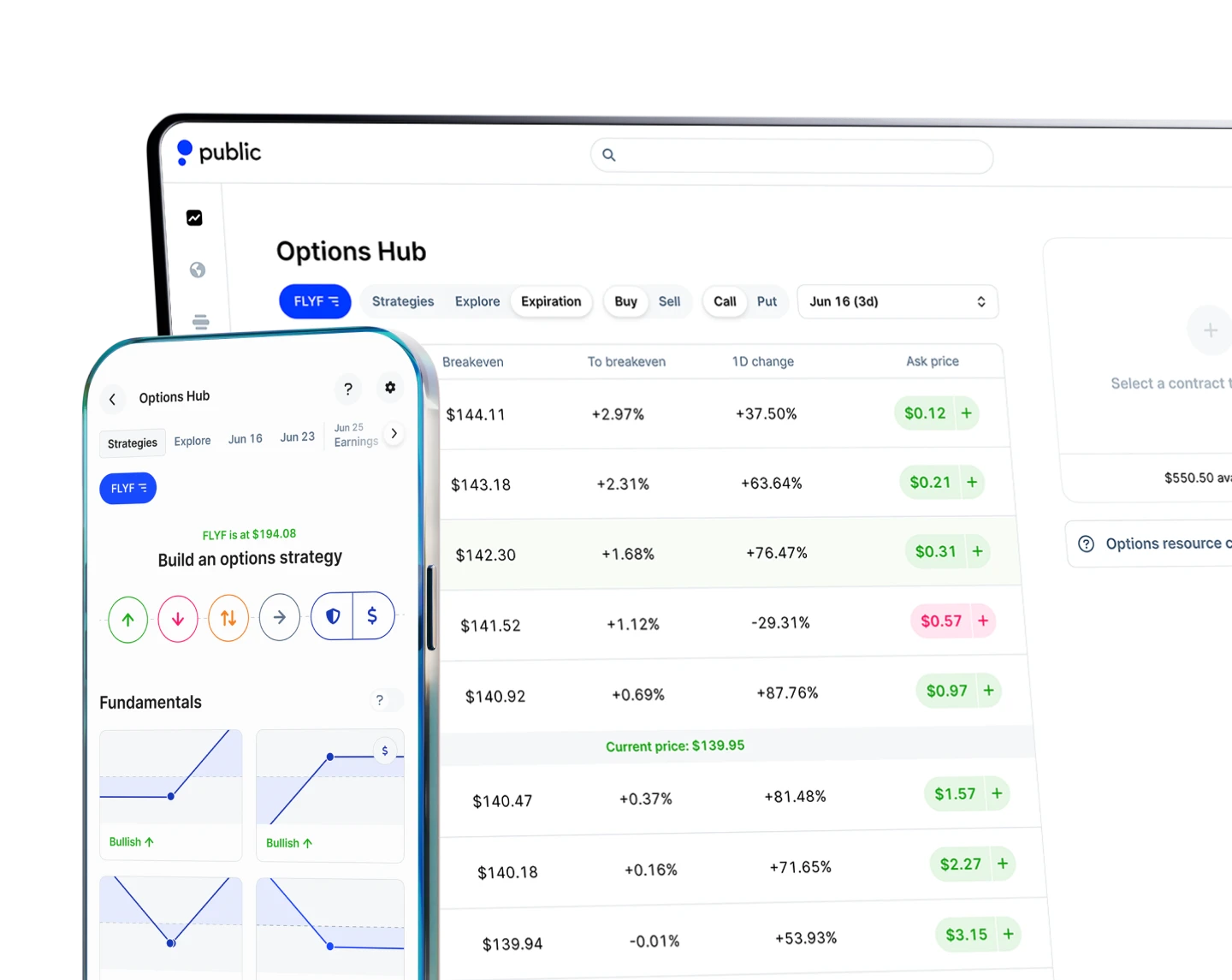

2. Explore the Bitcoin ETP options chain

Trading Bitcoin ETP options starts with a simple search. Enter the ticker symbol for a Bitcoin ETP in the search bar, head to the asset page, and click the “Trade Options” button.

3. Trade calls or puts on Bitcoin ETP options

Our Bitcoin options chain is designed to help you easily find contracts that match your investing strategy. Discover Bitcoin ETP options tailored to your strategy—trade single-leg or advanced multi-leg strategies seamlessly on Public.

4. Earn rebates on your options trades

When you trade options on Public, you can earn a rebate of $0.06–$0.18 per stock & ETF contract, based on your monthly trading volume, with no commissions or per-contract fees.

Get started

Instead of paying big fees to trade options,

how about getting something back?

Aside from the mandatory $0.06 regulatory fee, Public charges no fees and you get something back.*

| Broker | Rebate | Fees |

|---|---|---|

| Earn up to $0.18per stock & ETF contract traded | $0.06 per stock & ETF contract traded | |

| Robinhood | None | $0.04 |

| Fidelity | None | $0.67–$0.69 |

| TD Ameritrade | None | $0.66 |

Trading fees for competitors were taken from their website on 3/1/2025, and are exclusive of promo rates. The trading fees above are an approximation, are subject to change, and may vary based on factors such as the total number of contracts and price per contract. See terms & conditions for enrolling in Public’s options rebates at public.com/disclosures/rebate-terms.

*Fees listed apply to stock and ETP option contracts. See Fee Schedule for detail.

Boost your Options trading rebate

Each month, you can boost your rebate based on your trading volume and keep that tier for the following month.

-

$0.06 up to 999 stock & ETF contracts

Tier 1

-

$0.10 1,000-4,999 stock & ETF contracts

Tier 2

-

$0.14 5,000-9,999 stock & ETF contracts

Tier 3

-

$0.18 10,000+ stock & ETF contracts

Tier 4

Rebates are on stock and ETF option contracts only