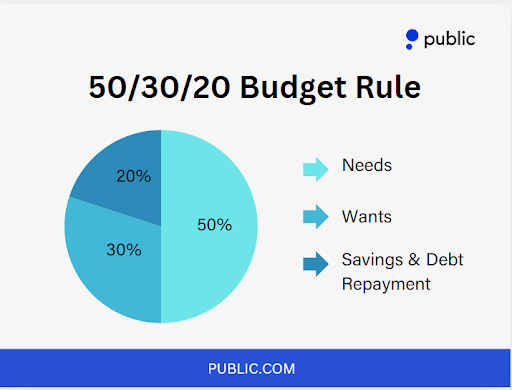

Managing finances can feel daunting, especially when you’re trying to balance spending, saving, and investing. One budgeting approach that has gained popularity for its simplicity and effectiveness is the 50/30/20 rule. By dividing your income into three clear categories—needs, wants, and savings—you can create a balanced budget that helps you meet both your short-term and long-term financial goals.

Let’s break down what the 50/30/20 rule is, how it works, and how you can apply it in today’s economy.

What is the 50/30/20 rule?

The 50/30/20 rule is a simple budgeting guideline that helps people manage their finances by dividing their after-tax income into three main categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings

Popularized in 2006 by Harvard Law Professor Elizabeth Warren and her daughter, Amelia Warren Tyagi, in their book, All Your Worth: The Ultimate Lifetime Money Plan, the 50/30/20 rule suggests dividing your after-tax income.

This approach simplifies budgeting, allowing you to cover your essentials, enjoy life, and save for the future.

Elements of the 50/30/20 budget rule

Let’s explore each category in more detail and see examples of applying the 50/30/20 rule.

1. Needs – 50% of your income

The “needs” category includes all essential expenses. These are the non-negotiable costs that you need to live, so prioritize covering these before anything else.

They are essentials we need every day and include:

- Housing: Mortgage payment or rental payment

- Utilities: Think water, sewer, electricity, and gas

- Car payments or other transportation expenses

- Insurance: Auto, health, home insurance

- Transportation: Gas, car payments, public transit, or ride-sharing costs

- Groceries: Basic food supplies for daily meals.

Example: If your monthly after-tax income is $5,000, you’d allocate $2,500 for needs. If your needs exceed this amount, try to adjust or reduce other costs – perhaps by considering alternatives for transportation or meal planning to keep grocery costs in check.

2. Wants – 30% of your income

Wants are the discretionary expenses that make life enjoyable. This category allows you to spend on things you value without sacrificing financial stability.

- Dining out: Meals at restaurants or take-out

- Entertainment: Movies, streaming services, concert tickets

- Shopping: Non-essential clothing or gadgets

- Travel: Weekend getaways or vacations

- Gym memberships

- Hobbies

Example: With $5,000 in monthly income, 30% for wants gives you $1,500. This way, you can enjoy some dining out, take a trip, or indulge in hobbies without straining your finances.

3. Savings and debt repayment – 20% of your income

This category is about building a stable financial future. This 20% should go toward savings, investments, and paying down any debt above the minimum payment.

- Retirement savings: Contributions to your 401(k) or IRA.

- Emergency fund: Set aside funds to cover three to six months’ worth of expenses.

- Investments: Stock purchases, ETFs, or other investment vehicles.

- Debt repayment: Extra payments on loans or credit card debt.

Example: With $5,000 in monthly income, you’d set aside $1,000 for this category. You might put $500 into a retirement account, $300 toward investments, and $200 for extra debt payments. This approach ensures you’re consistently building wealth.

Why the 50/30/20 rule works well?

With inflation and market volatility, many people are looking for a budgeting approach that is straightforward yet effective. The 50/30/20 rule is designed to help you make financial progress even as the cost of living rises. Here’s why it’s particularly relevant now:

- Inflation: With inflation affecting essentials like groceries and rent, prioritizing 50% of your income for needs ensures you’re covering the basics before anything else.

- Market volatility: In times of market uncertainty, having a dedicated portion of your budget for savings and investments may help build a financial cushion.

- Rising debt levels: For those paying off debt, allocating 20% to both savings and debt repayment may help you tackle financial liabilities while building security for the future.

How to budget with the 50/30/20 rule

Here’s how to set up a budget using the 50/30/20 rule:

Step 1: Calculate your monthly income after taxes.

Add up how much money is deposited into your account each month. For example, if you get paid bi-weekly, you’ll receive 2 paychecks most months. Total them together for your monthly budget baseline.

If you have retirement savings and health insurance benefits deducted from your paycheck, note that deduction amount and add that back in. It will be included in your savings category.

Step 2: Calculate the spending according to each of the 3 categories.

Next, multiply your take-home pay (the total of all your paychecks) by 0.50 for your needs allocation, 0.30 for your wants allocation, and 0.20 for your savings allocation. This is the basis for your 50/30/20 budget plan.

Step 3: Plug in your spending/monthly expenses into these categories.

You can think of the categories as 3 separate columns that you’ll put each of your monthly expenses under. Go through each one of your bills or financial responsibilities and put them each in the appropriate category. Once they are listed, add up the amounts due and see if your allocation covers those bills for each category of needs, wants, and savings. If you deducted your 401(k) contribution, you’d add that into your savings column.

Step 4: Follow the budget plan.

Track expenses to stay on track and make any adjustments needed to stay within your budget categories.

How does the 50/30/20 rule compare to the 70/20/10 rule?

Both are simple budgeting techniques designed to streamline finances without complex spreadsheets. While the 50/30/20 rule allocates 50% to needs, 30% to wants, and 20% to savings, the 70/20/10 rule differs slightly:

- 70%: Covers needs and wants like housing, utilities, groceries, recreation, and shopping.

- 20%: Goes to savings and investments such as a 401(k), IRA, or sinking funds for emergencies.

- 10%: Focuses on extra debt payments, donations, or gifts.

Using either method takes the confusion out of budget planning. Either can be perfect for all income levels since they each use percentages instead of dollar amounts. It can work at any level of experience, even for beginners.

Simplify your finances with the 50/30/20 rule

We shouldn’t have to spend endless hours organizing our finances, and by using the 50/30/20 rule, you won’t have to. It allows us to balance our income and expenses so we can live our lives and save at the same time, without worrying about outside factors like inflation impacting our investments.

Public is an all-in-one brokerage where you can build a multi-asset portfolio that includes everything from stocks and options to bonds, crypto, ETFs, igh-Yield Cash Account, and more.

Plus, you can access AI-powered fundamental data and custom analysis to guide your investment decisions. To expand your investment portfolio, sign up on the Public app today!